coefficient of variation finance

However the coefficient of variation is more commonly used when we want to compare the variation between two datasets. To find out how you can make your money go further read our guides to finance in Germany.

Coefficient Of Variation Definition Formula And Example

The coefficient can take any values from -1 to 1.

. In statistics coefficient of determination also termed as R 2 is a tool which determines and assesses the ability of a statistical model to explain and predict future outcomes. The interpretations of the values are. When to Use Each.

The standard deviation is most commonly used when we want to know the spread of values in a single dataset. The variables tend to move in opposite directions ie when one variable increases the other variable decreases. In other words if we have dependent variable y and independent variable x in a model then R 2 helps in determining the variation in y by variation x.

Coefficient of variation CV calculator - to find the ratio of standard deviation σ to mean μ. Regardless of the shape of either variable symmetric or otherwise if one variables shape is different than the other variables shape the correlation coefficient is restricted. Standard Deviation vs.

It ranges from -1 to 1 with plus and minus signs used to represent. The correlation coefficient denoted as r or ρ is the measure of linear correlation the relationship in terms of both strength and direction between two variables. Understanding your money management options as an expat living in Germany can be tricky.

The variables do not have a. The correlation coefficient is a value that indicates the strength of the relationship between variables. From opening a bank account to insuring your familys home and belongings its important you know which options are right for you.

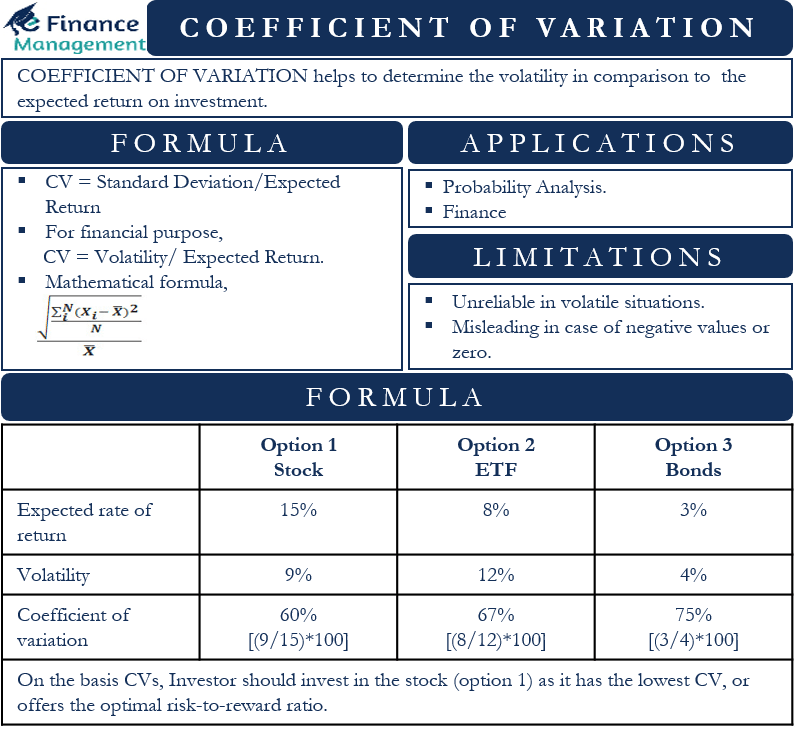

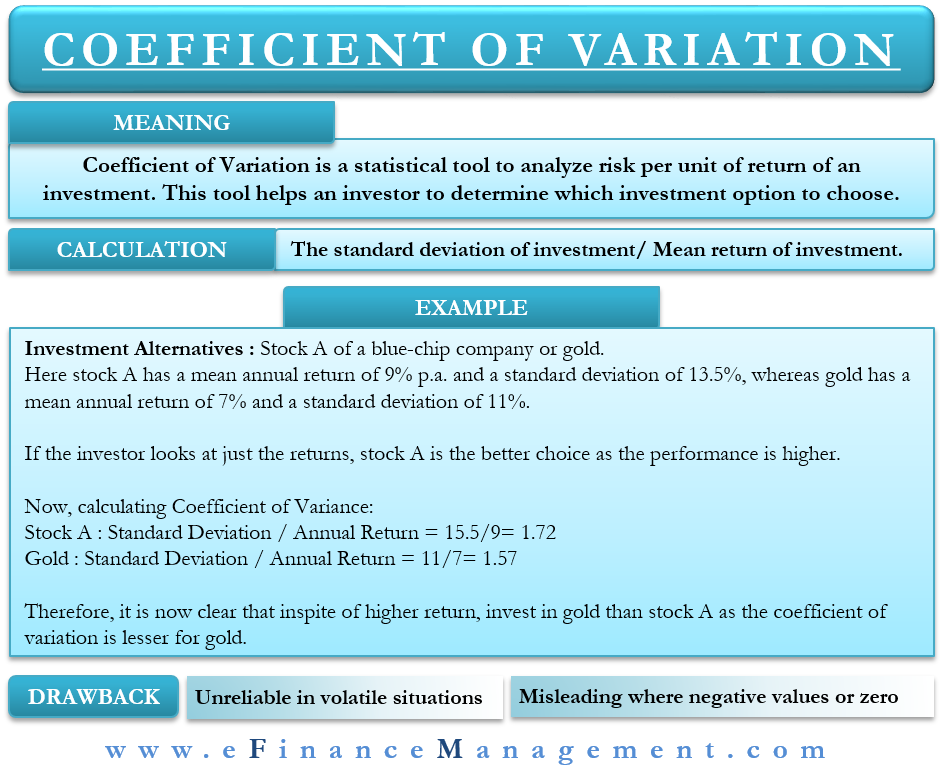

The main purpose of finding coefficient of variance often abbreviated as CV is used to study of quality assurance by measuring the dispersion of the population data of a probability or frequency distribution or by determining the content or quality of the sample data of substances. It is one of. For example in finance the coefficient of variation is used to.

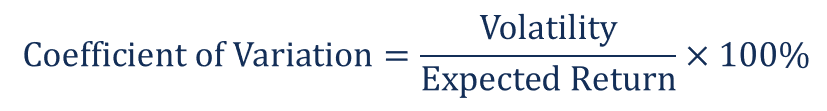

Investors use it to determine whether the expected return of the investment is worth. The correlation coefficient is restricted by the observed shapes of the individual X-and Y-valuesThe shape of the data has the following effects. The coefficient of variation COV is the ratio of the standard deviation of a data set to the expected mean.

Coefficient Of Variation Formula Calculation With Excel Template

Coefficient Of Variation Meaning Calculation Limitations

Coefficient Of Variation Meaning Formula Examples Uses

Coefficient Of Variation Calculator

Coefficient Of Variation Definition Formula How To Calculate

Coefficient Of Variation Meaning Calculation Limitations

Coefficient Of Variation Definition Formula And Example

0 Response to "coefficient of variation finance"

Post a Comment