Car Loan Requirements Malaysia

With the exception of boat or bike loans the loan amount should be rounded to the lower hundred ringgit amount. But when it comes to getting a car you should also take into consideration all.

5 Banks That Offer The Best Car Loan In Malaysia 2022

Individuals aged 18 years old and above sole proprietorships partnerships private limited and public limited companies.

. In terms of documentation you are required to have obtain Certificate of Entitlement COE Vehicle Quota System VQS and Electronic Road Pricing ERP which all cost a lot of money before you actually earn the eligibility to own a car. A minimum of 10 down payment is usually required by banks for the purchase of a brand-new car and about 20 for a used car. Earn at least Rs.

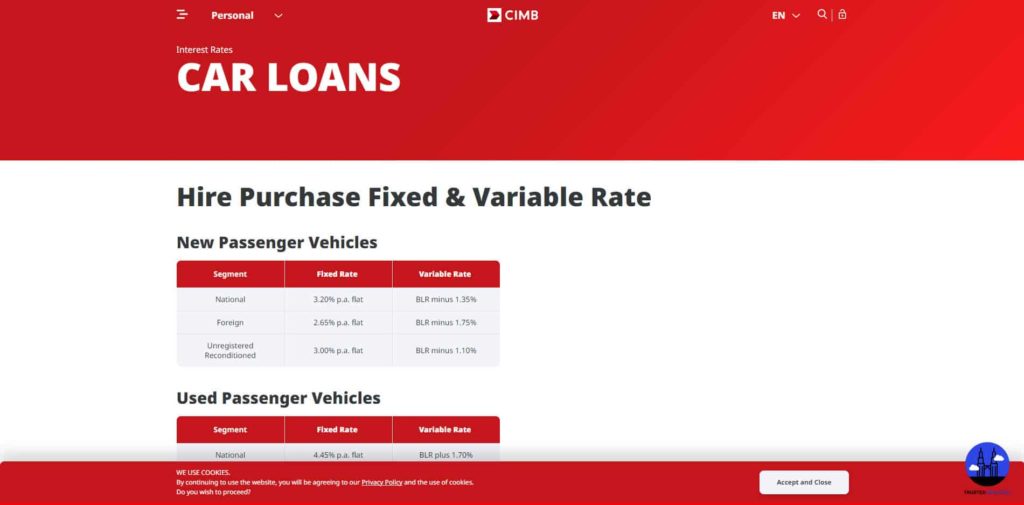

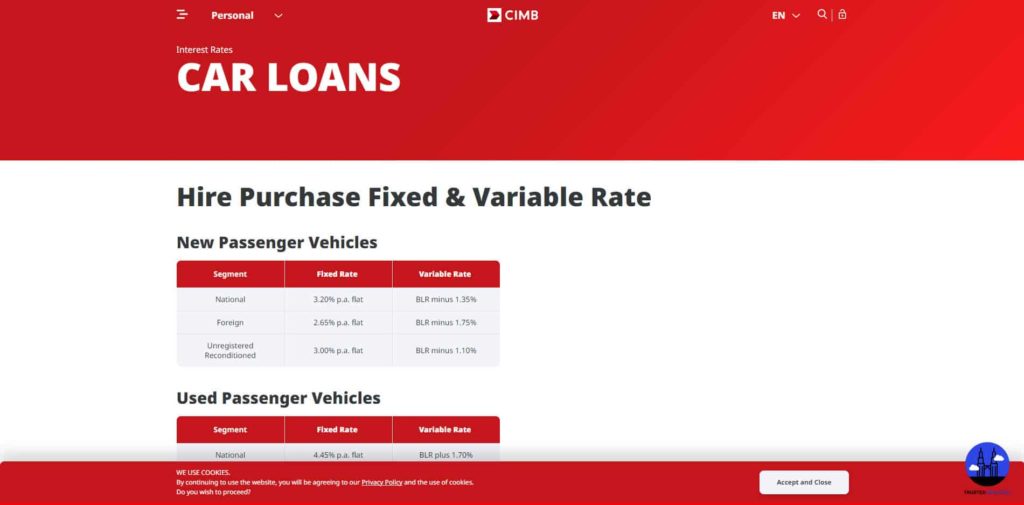

Car loans vary from bank to bank so be sure to compare as many as you can. Banks usually offer a maximum term of 9 years on the loan. You are required to pay a minimum down payment of 50 of the cars total value.

This means the person can only buy a car with a maximum value of RM45000. - If its RM65000 - an approved loan is RM59900. 180000 annually including the income of your spouseCo-applicant.

The bank only provide 90 loan unless you are a government staff and university graduated person. Ensure you have the proper documentation including. Most car loans in Malaysia have a maximum margin of financing of 90 so you should always expect to pay at least 10 upfront to the car dealer.

At least a Degree holder Employed for at least 1 month with a minimum salary of RM2500 Aged between 21 - 30 years old For those with less than 6 months of employment applications can still be considered if parents or siblings serve as guarantor. This also means that the cost to maintain the car is lower than per Tip 1 above. Things you should know about hire purchase loans in Malaysia.

In our opinion Tip 2 is more conservative compared to Tip 1. Down payments can also be paid by trading in your current vehicle. For example to buy a car with a net worth of RM59993 the officer has a maximum loan eligibility of.

Banks might offer a lower interest rate if you opt for a lower margin of finance. If you can afford to put down a bigger down payment you stand to save more on interest fees. Generate car loan estimates tables and charts and save as PDF file.

RM 12250 512 RM 20416. If not you still need a guarantor. Valid drivers license Work permit if youre taking out a loan Payslips from the last 3 months Bank statements from the last 3 months Letter from employer.

If an individual takes a loan period of 9 years he or she only needs to pay RM530 a month less than 10 of their net salary. Auto Financing Affordability Calculator. Shopping for a car loan for your new or used car.

Use our calculator to find out the estimated financing amount for your car. Requirements Required Documents Financing Application Form Copy of ID CardKTP Copy of Kartu Keluarga Family Card Copy of Bank Statements Copy of Salary SlipEmployment Letter Copy of SIUPTDPSKDP for Entrepreneur Copy of NPWP Certificate Of Domicile Copy of SPPT PBBPLNAJBSHM Home LOANS Car Loan. To apply for car loan you must have a salary of at least 3 times the monthly payment of the car.

60000 per annum if you are looking to buy a standard car and at least Rs. Looking to buy a new car. The deposit payment of any car purchase is usually 10 of the total car price.

If you can afford it consider paying a higher percentage upfront which will in turn lessen your principle loan amount as well as your interest. A Guarantor is required if an individual is below 21 or above 60 years old is a non-Malaysian or to prove affordability in meeting repayment obligations. Compare and calculate your monthly repayments on Loanstreets car loan calculator and save more than RM100 every month.

Malaysia car loan calculator to calculate monthly loan repayments. Undergraduates Pursuing a degree in a recognised institution of higher learning. Earn at least an income of Rs.

Compare Car Loans in Malaysia 2022. If its RM55000 an approved loan is RM55000. Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia.

Some car buyers prefer to pay a higher down payment to reduce the interest paid while some prefer to have more cash in hand. 37 rows Best Car Loans in Malaysia Whether youre buying a new or used car youll find our. To lessen the amount of interest it is advised to pay a higher percentage upfront.

When buying a new car in Malaysia youll need to follow a few key steps. Car loans commonly offer a maximum margin of financing of 90 hence you are expected to pay 10 of the car value to the dealership. Loan amount total interest loan period x 12 RM 70000 RM 12250 512 RM 137083.

Your Affordability Per Month.

Best Car Loans In Malaysia 2022 Compare And Apply Online

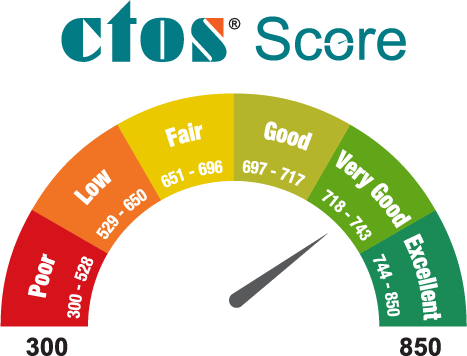

Car Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

Mytukar Offers Car Loan Interest Rate As Low As 1 68 Mytukar

Car Loan Calculator Malaysia Mod Apk Premium No Ads New Full Version Free Download Car Loan Calculator Loan Calculator Car Loans

Car Loan Company In Dehradun Dream Loan Finance Finance Loans Car Loans Loan Company

Secured And Unsecured Loans In Malaysia Check Out For More Unsecured Loans Loan Personal Loans

Mortgage Loan Company In India Loan Company Mortgage Loans Reverse Mortgage

0 Response to "Car Loan Requirements Malaysia"

Post a Comment